kern county tax collector change of address

Kern County Property Records are real estate documents that contain information related to real property in Kern County California. While the Kern County Treasurer-Tax Collector strives to provide accurate and up to date information no warranty or guarantee is made as to the accuracy timeliness performance completeness or suitability of the information and materials found or offered on this.

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Chose one of these options.

. Here you will find answers to frequently asked questions and the most commonly requested. Kern County Treasurer-Tax Collectors Office Suggest Edit. Property searches are allowed only by parcel identification numbers APN and ATN and address not by owner name.

The property tax rates are shown at a summary level and for individual properties. To our web site. Complete the Address Change form located on our forms page.

Bakersfield California 93301. Address Phone Number and Fax Number for Kern County Treasurer-Tax Collectors Office a Treasurer Tax Collector Office at Truxtun Avenue Bakersfield CA. Use our online tool to check for foreclosure notices and tax liens on a property.

This transfer is the result of a cotenants death. Please enable cookies for this site. The information posted on this website is subject to change without notice.

The Kern County sales tax rate is. Kern county tax collector change of address. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

The minimum combined 2020 sales tax rate for Kern County California is 725This is the total of state and county sales tax rates. Kern County Assessor Tax Assessor Details. Purchase a Birth Death or Marriage Certificate.

Get Information on Supplemental Assessments. In addition the website will include forms for change of address homestead exemptions and personal property exemptions specific to your situation. Signature of Person Requesting Change required Date Daytime Telephone.

Provide your name parcel number property address new mailing address daytime telephone number and a signature. It is an honor and a privilege to have the opportunity to serve the taxpayers of Kern County. Must be filed with each conveyance in the County Recorders office for the county where the property is located.

Requests are not accepted by telephone or email. FITCH KERN COUNTY ASSESSOR ATTN. A Notice of Supplemental Assessment relates to a new assessment resulting from a change in ownership or new construction.

Search for Recorded Documents or Maps. Kern County Treasurer and Tax Collector. It is important that we have your current mailing address to avoid unnecessary delays in delivery.

WHERE TO OBTAIN INFORMATION. Enter a 10 or 11 digit ATN number with or without the dashes. Our mission is to collect manage and safeguard public funds to provide community services to the constituents of Kern County and we strive to do this in the most efficient and effective manner possible.

Date of death _____ This section contains possible exclusions from reassessment for certain types of transfers. MAIL COMPLETED FORM TOJAMES W. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Search results will not include owner name. Change a Mailing Address. The request must be made in writing and signed.

Find Property Assessment Data Maps. Kern county assessor change of address form please type or print property valuation information and tax bills are mailed to the address contained in assessors office records. The California state sales tax rate is currently 6.

It is an honor and a privilege to have the opportunity to serve the taxpayers of Kern CountyOur mission is to collect manage and safeguard public funds to provide community services to the constituents of Kern County and we strive to do this in the most efficient and effective manner possible. Learn about the 10 Recorder Anti-Fraud Fee attached to the recording of several real estate instruments. How to Use the Property Search.

File an Exemption or Exclusion. Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values. Enter an 8 or 9 digit APN number with or without the dashes.

For all information regarding delinquent tax bills or a redemption from tax defaulted properties contact the County Treasurer-Tax Collector 1115 Truxtun Avenue 2nd Floor Bakersfield CA 93301-4639 661 868-3490 or use the 24 hour information system see item 4 below WHERE TO OBTAIN INFORMATION. Cookies need to be enabled to alert you of status changes on this website. This form may be sent via regular mail.

For all information regarding delinquent tax bills or a redemption from tax defaulted properties contact the County Treasurer-Tax Collector 1115 Truxtun Avenue 2nd Floor Bakersfield CA 93301-4639 661 868-3490 or use the 24-hour information system see Item 4 below. EFFECTIVE DATE OF THE CHANGE. Application for tax relief for military personnel.

KERN COUNTY ASSESSOR CHANGE OF ADDRESS FORM Please Type or Print Property valuation information and tax bills are mailed to the address contained in Assessors Office records. Sales tax rates are determined by exact street address. Property 2 days ago to our web site.

For all information regarding delinquent tax bills or a redemption from tax defaulted properties contact the County Treasurer- Tax Collector 1115 Truxtun Avenue 2 nd Floor Bakersfield CA 93301-4639 661 868-3490 or use the 24-hour information system see Item 4 below. Request a Value Review. They are maintained by various government offices.

Please select your browser below to view instructions. For all information regarding delinquent tax bills or a redemption from tax defaulted properties contact the County Treasurer-Tax Collector 1115 Truxtun Avenue 2nd Floor Bakersfield CA 93301-4639 661 868-3490 or use the 24-hour information system see item 4 below. File an Assessment Appeal.

EF-502-A-R12-0513-15000230-1 Kern County Assessor-Recorder Jon. ADDRESS UPDATE 1115 TRUXTUN AVENUE BAKERSFIELD CA. County of kern assessors office subject.

Jordan Kaufman Kern County Treasurer Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector

Property Tax Payment Due On By Dec 10 News Taftmidwaydriller Com

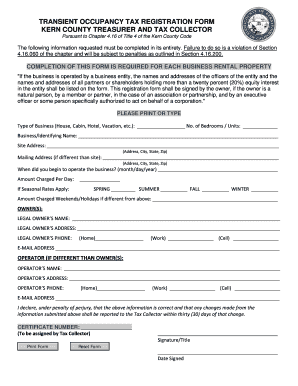

Fillable Online Kcttc Co Kern Ca Business Registration Form Kern County Treasurer And Tax Collector Kcttc Co Kern Ca Fax Email Print Pdffiller

County Tax Bills Mailed To Property Owners News Bakersfield Com

Kern County Treasurer And Tax Collector